India Payroll Professional

As Ensuring, accurate and timely payment to the employee is essential so adhering to the various statutory compliance is also critical. Any company must obey these laws as without which company can attract severe legal and financial consequences.

However, creating payroll is not an easy task. It’s very time consuming and continuous process. But then the question arises which department precisely responsible for the creation of payroll and compliance work? Is it an accounting or HR department?

Thought back in the past day’s most of the payroll task was handled by the accounting department but later on, gross payroll and compliance become part of HR department.

As there are many companies that provide payroll training course which explains all the information regarding payroll,payroll outsourcing, calculation of PF etc.

But before that you required to understand the basics of payroll so here we have included all the basic information regarding payroll.

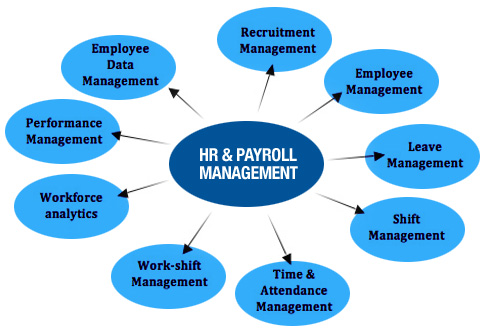

So now, we will try to understand what payroll compliance is and what the role of the HR department in it is.

For Free, Demo classes Call: 986042272 Register Now: https://prehr.com/

What Is Payroll?

In a simple word, payroll is a list of employees who get paid by the company. It also refers to the total amount of money the employer pays to the employees.

It Includes –

- Developing company’s pay policy which includes flexible benefits, leave encashment policy, etc.

- Defining payslip components like basic, variable pay, HRA, and LTA

- Gathering other payroll inputs (e.g., organization’s food vendor may supply information about the amount to be recovered from the employees for meals consumed)

- Calculation of gross salary, statutory as well as non-statutory deductions, and arriving at the net pay

- Releasing employee salary

- Depositing dues like TDS, PF, etc. with appropriate authorities and filing returns

So, in short, payroll process involves arriving at what is due to the employees also called as “net pay” after adjusting necessary taxes and other deductions.

Registration of company for Provident Fund

The Provident Fund is an amount of funds accumulated through regular and monthly contributions made by an employee and their employer. That is the reason it allows the employees to save some part of their income.

According to EPFO rules, any company which has 20 or more employees should register for Provident Fund.

If the company fail to comply with rules and regulations, then it will be charged with hefty penalties.

Now let’s see the calculation part of PF

Employees Provident Fund (PF):

PF is applicable where employees are >= 20. PF is deducted 12% on Basic Salary + Dearness Allowance (Earning Amount) as follows. If DA is not the part of salary structure, then PF will be calculated 12% on Earned Basic Salary only:

1) PF deduction restricted to qualifying amount Rs.15000/-

If PF deduction is restricted to qualifying amount of Rs. 5000/-, then it is deducted 12 % on Rs.15000/- or Actual Earning amount whichever is less.

2) PF deduction not restricted to qualifying amount Rs. 15000/-

If PF deduction is NOT restricted to qualifying amount of Rs. 15000/-, then it is deducted 12 % on Basic Salary + Dearness Allowance (Earning Amount). If DA is not the part of salary structure, then PF will be calculated Earned Basic Salary only :

C] Provident Fund (Employers Contributions) :

The employer contributes equally to the employee as follows :

1) Pension Fund : @ 8.33% subject to a maximum of Rs. 1249/- p.m. to be contributed to Pension Scheme by employer.

2) PF Contribution: The difference between 12% & 8.33% to be contributed to PF account by the employer.

Provident Fund Challan :

A/c No. 1 = Employer’s share of PF contribution (12%) + Employee’s share of PF contribution (3.67%)

A/c No. 2 = Administrative charges @ 0.65% on Earning Amount

A/c No. 10 = Employer’s Pension contribution 8.33%

A/c No. 21 = E.D.L.I. Charges: @ 0.50% on Qualifying Amount

Registration of company for ESIC (Employees’ State Insurance Corporation)

The ESIC social security scheme brings reasonable healthcare to employees and their family members. As per the ESIC Act, all the companies consisting of more than 20 employees whose monthly salary falls under Rs.21,000 should register under the Act.

ESIC social security scheme brings reasonable healthcare to employees and their family members. As per this ESIC Act, its compulsory for all companies with more than 20 employees whose monthly salary falls under 21,000 should register under this act.

So, if the company falls under this act, then the Employees CTC needs to be updated including the ESIC employer and employee contribution

Now let’s check the facts below

Statutory Compliance

Profession Tax (PT) :

PT is deducted on Gross Earning salary as per slabs. The PT slabs vary from state to state.

The PT slabs for Maharashtra State are as follows :

From To Tax

0.00 7500 0.00

7501 10000 175

10001 above 200 Rs.300 /- for Feb Month (2500/year)

For Female – Upto 10,000 = Nil

Employees State Insurance Corporation (ESIC) :

If ESIC is applicable to company, then it is deducted on Gross Earning Salary 1.75% Employee & 4.75% Employer .

The ESIC applies to employees whose Gross Master Salary is <= 21,000 (wef. 1st Jan2017, earlier it was 15,000). The ESIC eligibility has to check twice in a year (Apr. & Oct.)

Gratuity Act, 1972

The payment of Gratuity Act was passed in the year 1972 and covers employees engaged in mines, factories, oil fields, plantations, companies and ports for more than ten employees. The gratuity amount, unlike the provident fund, is totally paid by the employer without any contribution from the employee.

Any establishments where 10 or more persons are employed or were employed on any day of the preceding 12 months is liable to pay gratuity to its employees. Once the Act becomes applicable, it continues even if the number of employees falls below 10.

Entitlement: Gratuity is payable to an employee (nominee – in case of death of employee) who has rendered continuous service of five years or more on his termination of employment, superannuation, retirement or resignation. Completion of continuous service of five years is not necessary where the termination of employment is due to death of disablement.

Eligibility for Gratuity:

- An employee should be eligible for superannuation

- An employee retires

- An employee resigns after working for 5 years with a single employer

- An employee passes away or suffers disability due to illness or accident

Let’s look at the calculation of Gratuity:

W x Y x 15/26 where W = Last Wage drawn i.e., basic + DA

Y = number of completed years of continuous service (six months or less to be ignored and more than six months to be counted as full-year only if the company is registered under Gratuity scheme)

15 = 15 days salary

26 = No. of working days in a month.

Time Limit for application to the employer:

The employee has to make an application in Form-I to his employer within 30 days from the date of gratuity becomes payable.

About preHR

PREHR is the HR learning and development organization based in Pune, India that can equip you with the professional HR skills you need to be truly effective in the workplace.

We provide, innovative human resource consulting services and comprehensive human resource management development training program which includes payroll training over a full range of issues related to the workforce management. Our client centred solutions and overall business knowledge can assist in improving productivity, efficiency and communications.

We help hr freshers to be job ready by providing HR training courses. To Attend FREE Classroom demo session. Call us today at 91- 9860422727

Great content! Super high-quality! Keep it up! 🙂