Registration of company for ESIC (Employees’ State Insurance Corporation)

The ESIC social security scheme brings reasonable healthcare to employees and their family members. As per the ESIC Act, all the companies consisting of more than 20 employees whose monthly salary falls under Rs.21,000 should register under the Act.

ESIC social security scheme brings reasonable healthcare to employees and their family members. As per this ESIC Act, its compulsory for all companies with more than 20 employees whose monthly salary falls under 21,000 should register under this act.

So, if the company falls under this act, then the Employees CTC needs to be updated including the ESIC employer and employee contribution

If ESIC is applicable to company, then it is deducted on Gross Earning Salary .

The ESIC is applicable to employees whose Gross Master Salary is <= 21,000 (wef. 1st Jan2017, earlier it was 15,000).

ESIC contribution rates has been reduced from 6.5% to 4% with effective from 1st July 2019.

The ESI Scheme aims to provide hassle free services to both employers and employees through its information portal and services portal. As part of this effort, all compliance and payments are covered through internet. Employers can remit monthly contributions through portal. Presently, the online payment is enabled for SBI account holders having net banking facility.

Two important aspects for making online payment:

1. SBI internet banking user id and Password

2. ESIC user id and password

Please type www.esic.in in the address bar and the page will be converted to https://www.esic.in/ESICInsurance1/ESICInsurancePortal/PortalLogin.aspx automatically

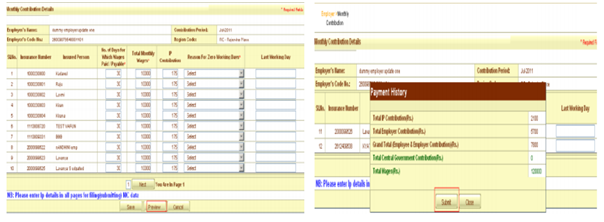

Monthly contribution filing

- User can file the monthly contribution via “Online Monthly contribution Screen”.

- On submission “preview” page will be displayed

- To submit the monthly contribution details to ESIC click “Submit” button (refer screen shot)

The user can manually type the contribution against each employee or can upload an excel file as an attachment for bulk upload. This is quite user-friendly for bulk data

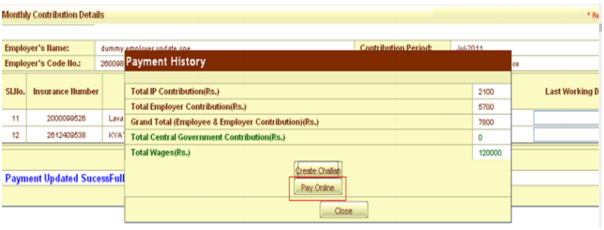

After submission user can make the online payment via SBI net banking by clicking on Pay online.

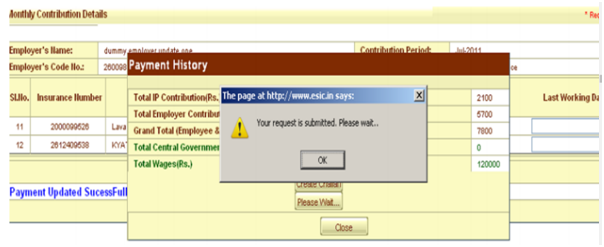

6. Click on “ok” to proceed further with the online payment.

7. For future reference please note down the Challan number.Click on continue to proceed for the payment this will redirect to SBI online payment page.

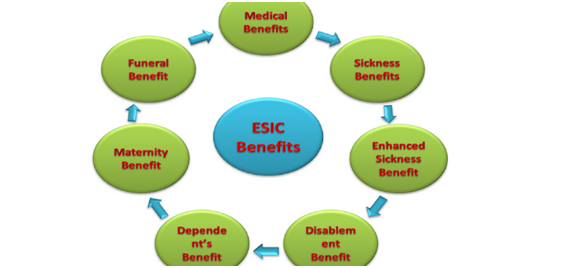

Key Feature of ESI

1.Medical Benefit

2.Sickness Benefit

3.Maternity Benefit

4.Disablement Benefit

5.Dependents Benefit

6.Unemployment Allowances

Many More…