The New Wage Code is implemented from the next financial year, i.e. 2022-23. According to media reports, the new wage code can be implemented anytime after April 2022. According to the new rules, Basic Salary will be at least 50

Salary Package Impacting

Increment impact“If the basic pay to gross pay ratio is around 30% and it moves up to 60% after implementation of the ‘Code on Wages’ . we would expect the liabilities on account of the above schemes to double, said

Industrial Relations Code, 2020

On September 23, 2020, India’s Parliament passed 3 (three) long-awaited labour codes: The Industrial Relations Code Bill, 2020 The Code on Social Security Bill, 2020 The Occupational Safety, Health and Working Conditions Code Bill, 2020 The labour codes subsequently received

Atmanirbhar Bharat RozgarYojana(ABRY)

As you are aware that the country has been facing the impact of the COVID 19 pandemic since March 2020. Covid -19 Safe Workplace Guidelines for Industry and Establishment has been issued by EPF. Central Govt. has recently launched Atmanirbhar

Maharashtra Labour Welfare Fund

The Bombay Labour Welfare Act, 1953, came to existence on 17th June 1953, is but a most critical measure since its activities give benefits to the workers and their families and dependents. The Maharashtra Labour Welfare Board is a statutory

How do you understand HR Department?

The Human Resource strategy sets the direction for all the key areas of HR, including hiring, performance appraisal, development, and compensation. The HR strategy is thus a long-term plan that dictates HR practices throughout the organization. If HR executes these

HOW TO AVAIL BENEFIT UNDER #PMGKY

benefit under pmgky

EPF Contribution reduced to 10% for 3 month

FM Nirmala Sitharamn to announce 5th & final tranch of economic package EPF contribution of private sector employers, employees cut to 10% for 3 months. Portability of welfare benefits for mirgrant workers. Extension of ESIC coverage pan-India to all districts

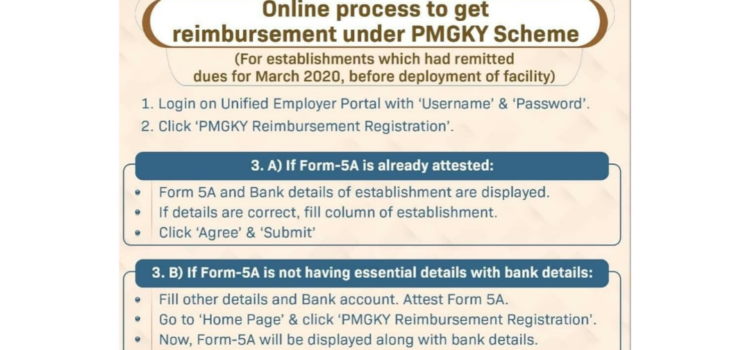

Online Procedure to receive reimbursement of benefits under #PMGKY

Above there is procedure follow for employers seeking reimbursement of PMGKY benefits since they remitted for March 2020 prior to deployment of facility in ECR on 13n April 2020. These is guided to complete the above process for March 2020.

Income Tax For FY 2020-21

From Financial Year 2020-21, an individual taxpayer will have an option to choose between existing and new tax regime. There are two regimes 1. Old (current) 2. New Old Regime: Previous year TDS slab will remain same for current financial year